The inclusion of the concept of “beneficial owner” into Vietnam’s Law on Enterprises marks a strategic and urgent move in the country’s efforts to deepen global economic integration and fulfill its commitments to financial transparency, anti-money laundering (AML), and combating the financing of terrorism (CFT). This development is not only driven by international obligations but also by Vietnam’s internal need to enhance corporate governance, improve the business environment, and prevent tax evasion.

1. Beneficial Ownership – A Cornerstone of Modern Corporate Governance

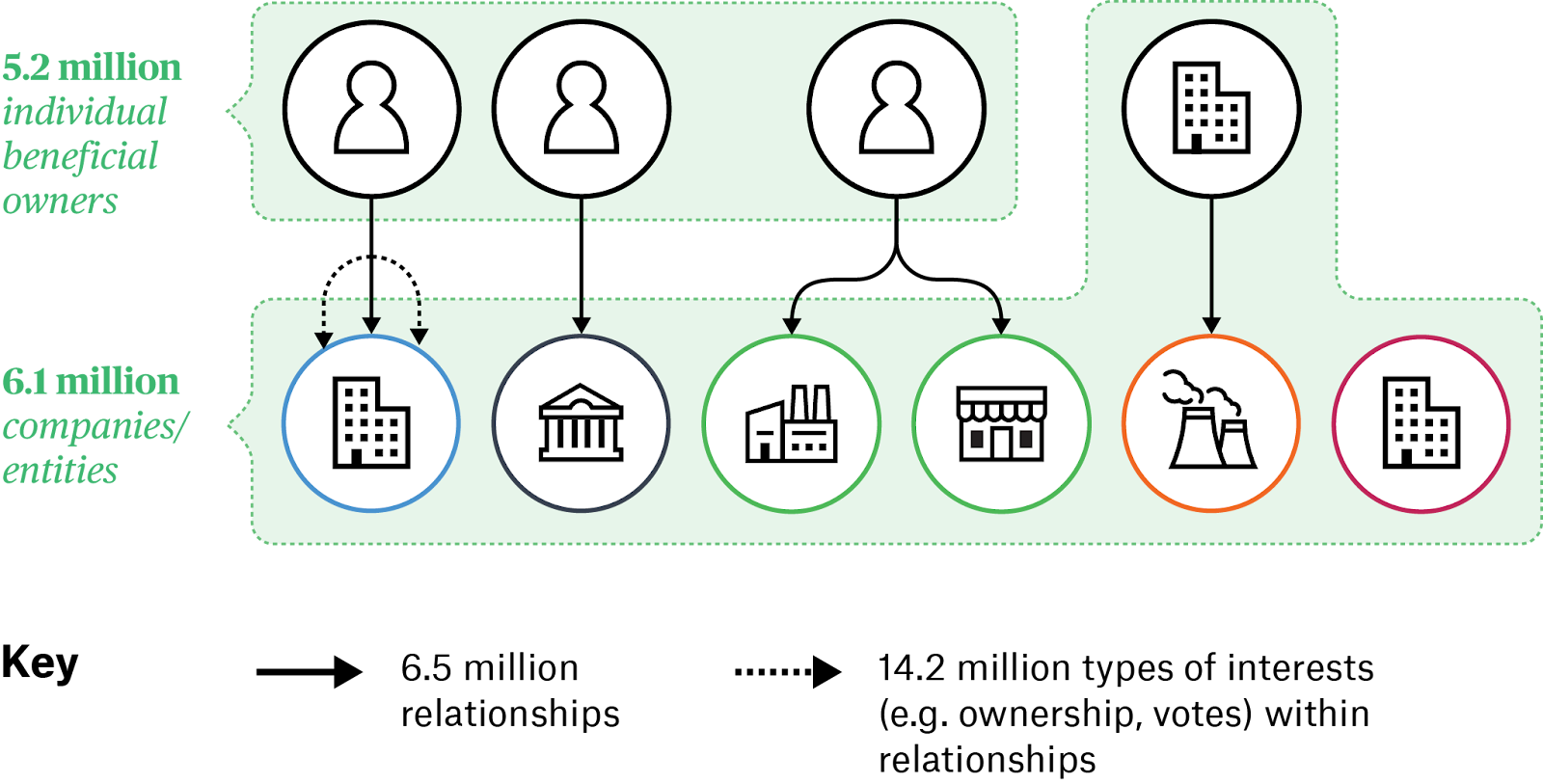

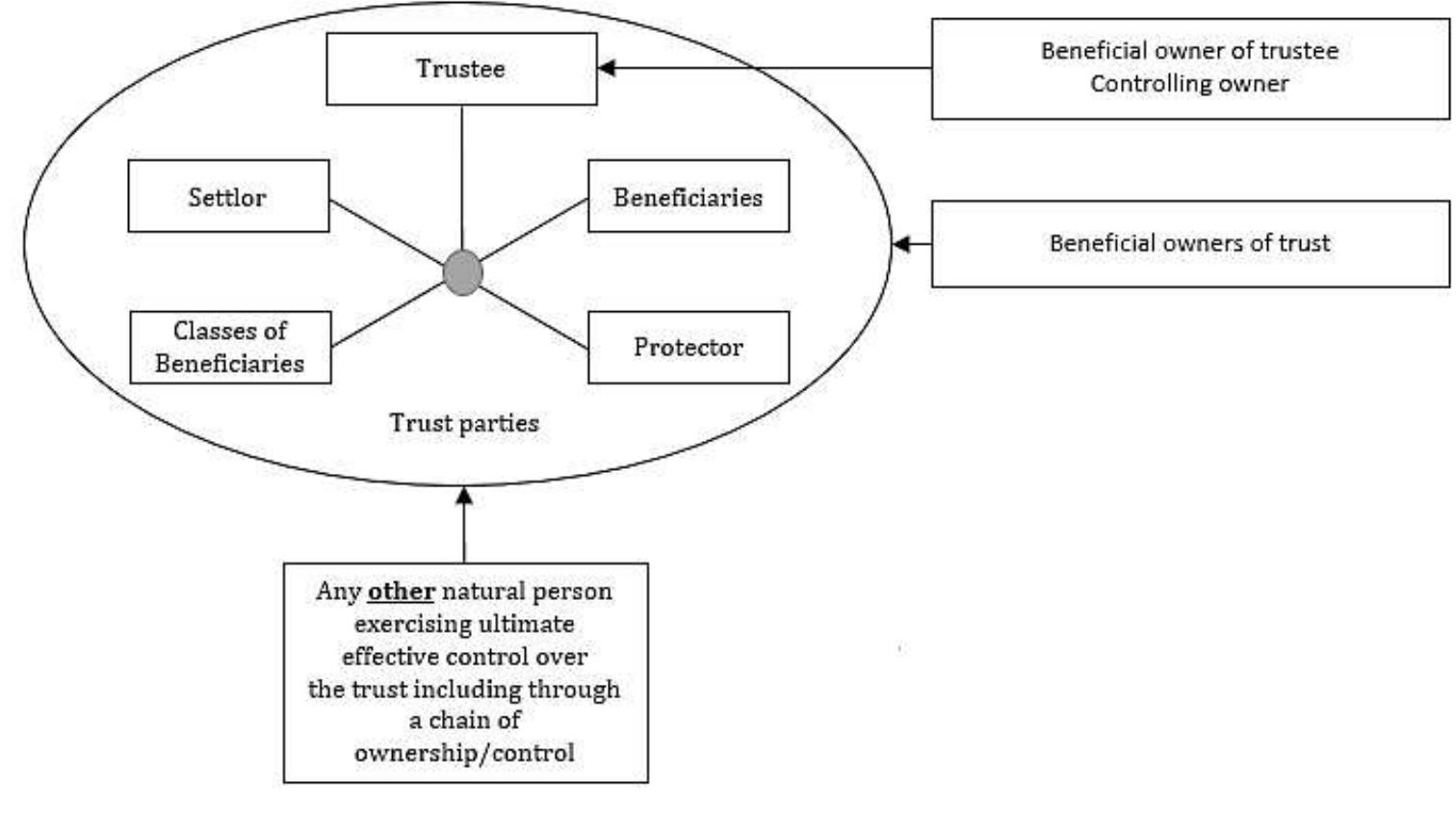

A beneficial owner (BO) is the individual who ultimately owns or controls a legal entity, even though they may not be named in official documents such as the business registration certificate. These individuals often operate behind layers of complex structures such as parent-subsidiary chains, offshore companies, or nominee arrangements.

In any transparent economy, identifying the actual controllers or beneficiaries of a business is crucial in preventing money laundering, tax avoidance, transfer pricing, market manipulation, and the abuse of corporate structures. Recognizing this, international organizations including the Financial Action Task Force (FATF), World Bank, IMF, and major trade agreements like the CPTPP and EVFTA, have made the identification of BOs a global standard.

2. Pressure from FATF and the Consequences of Being Grey-Listed

In 2023, FATF officially placed Vietnam on its “grey list” of jurisdictions with strategic deficiencies in AML/CFT measures. One of the primary reasons was the lack of an effective mechanism to identify and disclose beneficial ownership information.

This designation carries serious implications:

– Cross-border financial transactions involving Vietnam are subject to enhanced scrutiny;

– Borrowing costs may rise due to perceived legal risks;

– The country’s reputation suffers among international financial institutions and investors;

– Vietnam may face restrictions or refusals in international financial dealings.

To be removed from this list and regain international confidence, Vietnam must promptly adopt international standards on ownership transparency—starting with defining and regulating BOs in its Law on Enterprises and other related laws such as the Anti-Money Laundering Law.

3. Filling Legal Loopholes and Strengthening Corporate Oversight

Before the concept of BO was introduced, Vietnamese laws only required the disclosure of registered shareholders or capital contributors. This left a legal grey area, enabling individuals to hide behind proxy owners or shell companies.

Such legal ambiguity has led to:

– Tax evasion and transfer pricing abuses through offshore entities that facilitate profit shifting;

– Complicated internal disputes when true control cannot be established solely from official documents;

– Backdoor ownership structures allowing public officials or interest groups to hide personal stakes through relatives or associates.

Mandating the disclosure of beneficial ownership information will close these loopholes, improve governance, and protect the rights of all stakeholders involved.

4. Boosting Investor Confidence and the Business Environment

Ownership transparency is a key factor in how foreign investors assess market risks. Investment funds, banks, and international auditing firms require accurate BO information before partnering with or investing in a company.

Without clear BO regulations, Vietnam risks losing access to high-quality investment flows. On the other hand, adopting these standards can:

– Improve transparency and reduce legal risks;

– Assist regulatory bodies like tax authorities, securities commissions, and banks in their supervisory roles;

– Improve Vietnam’s competitiveness and international rankings on transparency.

5. Implementation Challenges – But No Time to Delay

Introducing the concept of beneficial ownership is more than just adding a legal definition—it requires a comprehensive regulatory framework. Key challenges include:

– Building a centralized, accurate, and up-to-date BO database, accessible to relevant authorities;

– Defining clear responsibilities for BO declaration and verification between businesses and government agencies;

– Balancing data privacy with transparency to protect personal information while ensuring public interest;

– Establishing strict penalties for non-compliance, false reporting, or concealment of BO information.

However, these challenges are not grounds for delay. Many countries have successfully implemented BO regulations, and Vietnam can learn from international best practices to develop a system that fits its specific context.

The move to incorporate beneficial ownership into Vietnam’s Law on Enterprises is both urgent and necessary. It is a critical step not only in response to international pressure, such as from FATF, but also in pursuit of a transparent, accountable, and globally integrated economy. By prioritizing long-term national interests and regulatory integrity, Vietnam is setting the stage for sustainable development and a more trusted investment environment.

Orther relevant legal articles:

- Labor & Employment Dispute Resolution: Legal Support in Hanoi

- Labor Laws and Employment Compliance for FDI Businesses in Vietnam

- Legal Advice when you start a Business in Vietnam 2025

- Legal Services Every Expat Business Owner in Vietnam Needs