Understanding Vietnam’s Trade Remedy Enforcement and How to Prepare

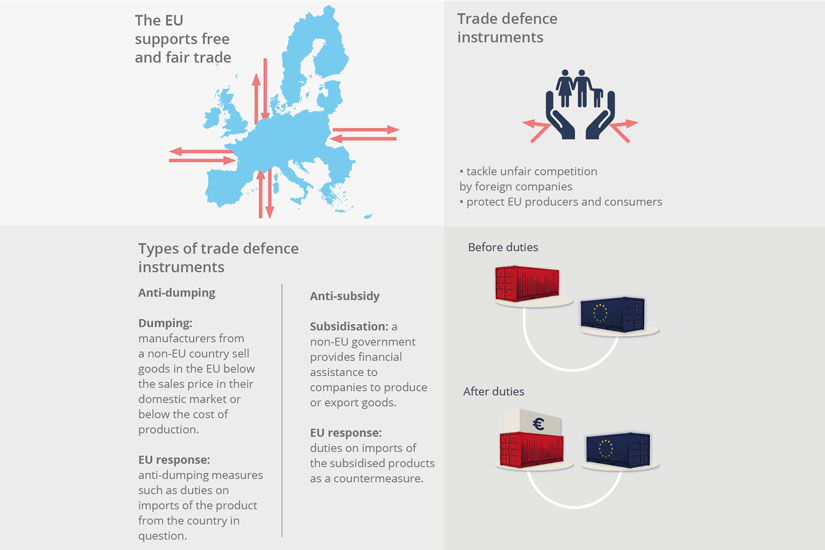

Foreign manufacturers and global trading companies are increasingly choosing Vietnam as a core export destination and supply-chain hub. Yet, with this growth comes a critical trade compliance challenge: Vietnam is more actively using anti-dumping duties, both provisional and final, to protect domestic industries.

For international exporters, the key question is not only whether Vietnam will apply anti-dumping measures, but when duties can take effect and how to minimize their impact.

This article breaks down the legal framework, enforcement practice, and practical steps for companies to safeguard market access and cash flow when facing anti-dumping investigations in Vietnam.

✅ What Are Provisional Anti-Dumping Duties?

Provisional anti-dumping duties are temporary tariffs that Vietnam may impose during an ongoing investigation if there is evidence that:

- Dumping exists

- Domestic industry is suffering or at risk of serious harm

- Delay would cause further injury

Legal basis: Law on Foreign Trade Management & Decree 10/2018/ND-CP.

📌 Timing

Provisional duties can be imposed:

- After a preliminary review of data submitted by exporters

- Usually around 120–180 days from initiation of investigation

Duration: up to 120 days, extendable to 180 days in special cases.

📌 Form

Provisional measures may take the form of:

- Additional import duty

- Security deposit / bank guarantee

In practice, security deposits are widely used, creating liquidity pressure for exporters and importers.

✅ What Are Final Anti-Dumping Duties?

Final anti-dumping duties are imposed after the full investigation is completed and conclusive evidence is established.

Duration: typically 5 years, with possibility of review and extension.

The final duty rate may:

- Confirm the provisional rate

- Reduce it

- Increase it, based on verified data

Once imposed, refunds of provisional deposits are possible if final duties are lower — but the process can be time-consuming and is not guaranteed if data was insufficient.

✅ How These Duties Affect Foreign Exporters

📍 1) Market Access Shock

A provisional duty can immediately halt export viability — especially for price-sensitive industries such as steel, chemicals, plastics, wood products, and consumer goods.

📍 2) Financial Pressure

Security guarantees and duty deposits tie up capital and reduce liquidity, affecting:

- Working capital cycles

- Cash management

- Credit capacity

For SMEs and mid-size exporters, the financial stress can be significant.

📍 3) Supply Chain Disruption

Importers may suspend orders or shift to alternative suppliers. End-customers may hesitate to sign long-term contracts.

📍 4) Reputational Impact

Anti-dumping listings are monitored by trade authorities globally. A case in Vietnam can trigger scrutiny in other markets.

✅ Timeline Snapshot

| Phase | Duty Status | Key Action for Exporter |

| Investigation begins | No duty | Prepare defense, gather data, appoint counsel |

| Preliminary review | Provisional duty possible | Submit questionnaire & pricing data |

| Final determination | Final duty effective for 5 years | Appeal, review, or negotiate cooperation level |

| Annual / sunset review | Duty may change or expire | File for review if conditions met |

✅ Can Exporters Reduce or Avoid Duties? Yes — With the Right Strategy

1) Cooperate Early and Fully

Vietnam frequently applies the “adverse facts available” principle.

Non-cooperation = highest duty rate.

2) Provide Complete and Consistent Data

Price lists, cost sheets, audited accounts, logistics costs, and invoices must align.

Data inconsistencies are one of the top reasons companies lose their defense.

3) Request Separate Duty Rates

Where exporters belong to business groups, clear separation and evidence may reduce the rate.

4) Use Legal Counsel to Engage Authorities Professionally

Experienced Vietnam-based trade lawyers help with:

- Filing extensions

- Responding to questionnaires

- Managing verification visits

- Navigating cultural & regulatory expectations

5) Prepare for On-Site Verification

Clean records, trained staff, and organized documents are essential.

Companies who prepare poorly often face unfavorable findings.

6) Apply for Review

Exporters can request:

- Interim review

- New-shipper review

- Sunset review

If business conditions change or cooperation improves, duties can be lowered or lifted.

✅ Lessons from Recent Enforcement Trends

Vietnam’s enforcement style reflects a balance of WTO compliance and domestic industrial protection. Emerging patterns include:

- More frequent provisional duties than before

- Stricter documentation verification

- Greater scrutiny of related-party transactions

- Sensitivity to sudden import surges

- Increasing use of trade remedies in high-value sectors

Regulators expect professionalism, transparency, and good-faith cooperation.

Well-prepared exporters often achieve reduced or zero duties.

✅ Practical Compliance Checklist

| Action | Benefit |

| Establish trade-compliance team | Faster and accurate responses |

| Audit cost & pricing systems | Prevent data inconsistencies |

| Track Vietnam import volumes | Avoid sudden spikes triggering review |

| Create defense files in advance | Respond quickly to investigation |

| Engage local counsel and accountants | Ensure legal & financial accuracy |

| Monitor policy updates & public notices | Early warning = strategic advantage |

✅ How La Défense Supports Foreign Exporters

La Défense advises international companies on:

- Anti-dumping investigations and defense strategy

- Responses to questionnaires and verification support

- Customs & trade-compliance audits

- Separate-rate and new-shipper reviews

- Supply-chain and pricing structure advisory

- Coordination with foreign law firms and compliance consultants

We combine:

- Insight into Vietnam’s legal & regulatory environment

- International trade and cross-border experience

- Clear business-focused communication for foreign clients

Our aim is to support long-term, stable, and compliant operations in Vietnam’s dynamic market.

Provisional and final anti-dumping duties in Vietnam are powerful instruments that can reshape market dynamics overnight. Foreign exporters that understand the process, prepare early, and respond strategically will protect:

- Market access

- Profitability

- Supply-chain stability

- Corporate reputation

In trade law — proactive preparation always costs less than reactive defense.

Let’s Navigate Vietnam’s Trade Environment Confidently

If your company is planning exports to Vietnam or seeking guidance during an ongoing investigation, our team is here to support with a practical, confidential, and business-oriented approach.

We are ready to help you build durable and compliant market access in Vietnam.