By Lawyer Linh Nguyen – Senior Partner

Background: When Investment Trust Turns into Legal Confrontation

In 2016, the acquisition between VMG Media, a Vietnamese digital and fintech company, and UTC Investment Co., Ltd. from South Korea, was hailed as one of the most notable fintech M&A deals in Vietnam at the time.

Under the agreement, VMG sold 62.25% of its stake in VNPT EPAY, a licensed intermediary payment service provider, to UTC for an estimated USD 34 million. The deal was expected to create a strategic partnership bridging local innovation and foreign capital.

However, what began as a promising collaboration eventually evolved into a multi-year legal battle — now seen as a landmark example of post-M&A dispute risk in Vietnam’s emerging market.

Timeline: From Strategic Partnership to International Arbitration

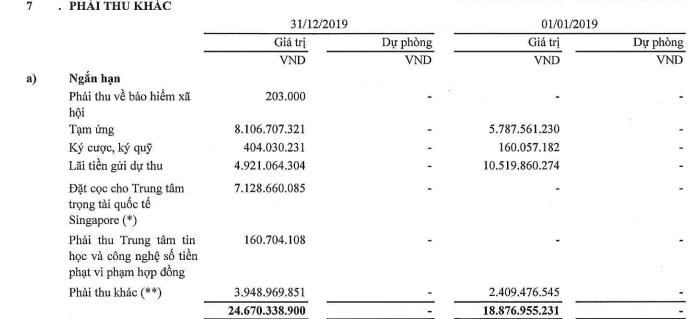

Following completion of the transaction, UTC and its subsidiary Global Payment Server Pte Ltd. (GPS) discovered alleged irregularities in VNPT EPAY’s operations.

According to UTC, financial data and compliance information disclosed during negotiations were inaccurate or incomplete. Some of VNPT EPAY’s business partners were allegedly linked to illegal online gambling platforms, in violation of Vietnamese law.

UTC claimed that these issues amounted to breach of representations and warranties, particularly those guaranteeing legal compliance.

In 2020, UTC and GPS initiated arbitration at the Singapore International Arbitration Centre (SIAC), seeking damages for breach of warranty and misrepresentation.

After proceedings, the SIAC tribunal ruled in favor of UTC, ordering VMG to pay approximately VND 626 billion (around USD 27 million) plus interest of 5.33% per year from 21 October 2021 until full payment.

The award, several times higher than VMG’s equity, posed a serious financial challenge for the Vietnamese seller. VMG later announced its intention to petition Vietnamese courts to refuse recognition of the SIAC award, citing potential breaches of public policy and due-process principles.

As a result, the dispute continues into a new and complex phase: recognition and enforcement of a foreign arbitral award in Vietnam.

Legal Analysis: Understanding the Nature of Post-M&A Disputes

1. The Legal Nature of the Dispute

The VMG–UTC case typifies a post-M&A dispute — arising after completion, when the buyer alleges that the seller’s warranties or disclosures were false or misleading.

Under both international practice and Vietnamese civil law:

- Article 444 of the 2015 Civil Code requires the seller to ensure truthful information and lawful ownership of transferred assets;

- Article 419 entitles the non-breaching party to claim compensation for damages and lost profits.

Where a seller provides misleading or inaccurate representations, the breach may trigger substantial contractual liability. The SIAC tribunal concluded that VMG had breached its warranties by failing to disclose material legal and compliance risks.

2. Arbitration and Enforcement Challenges

The parties’ agreement designated SIAC arbitration in Singapore as the dispute-resolution forum.

While Vietnam is a party to the 1958 New York Convention, enforcement of a foreign arbitral award still requires recognition by the competent Vietnamese court under the Civil Procedure Code.

VMG may request non-recognition if it can demonstrate that:

- The tribunal exceeded its authority;

- The arbitral procedure violated due process; or

- The award conflicts with Vietnam’s fundamental principles of law or public policy.

This reflects a key reality in cross-border M&A: even a valid international award does not guarantee domestic enforceability — a risk that foreign investors and local sellers alike must evaluate carefully.

3. Contractual Risk and Legal Drafting Lessons

The case exposes several drafting deficiencies common in emerging-market M&A transactions:

- Overly broad warranty clauses such as “full compliance with all laws,” without defining scope or time limits;

- Absence of a liability cap, leaving the seller fully exposed to unlimited damages;

- No disclosure schedule to shield the seller from known and disclosed risks;

- No claim period limiting how long after completion claims may be brought.

Given the high-risk nature of fintech and payment services, these omissions left VMG legally unprotected and vulnerable to massive post-closing exposure.

Professional Observations and Key Takeaways

The VMG–UTC arbitration highlights the maturity gap between transactional ambition and legal readiness in Vietnam’s M&A landscape.

From a lawyer’s perspective, several lessons emerge:

1. Transparency Is the Seller’s Best Defense

In any M&A transaction, transparency is not only ethical but also a binding legal obligation.

Failure to disclose material risks or provide accurate data can lead to catastrophic liability, as well as reputational damage that far outweighs the short-term gains of concealment.

2. Standardization to International M&A Practice Is Essential

Every M&A contract should include:

- Clearly defined representations and warranties;

- A liability cap and de-minimis thresholds;

- A comprehensive disclosure schedule;

- A realistic claim period and enforcement mechanism that aligns with local legal practice.

Relying on simplified contract templates or neglecting specialized legal review is a costly mistake — especially in high-value cross-border deals.

3. International Arbitration: Independence vs. Enforceability

International arbitration ensures neutrality and professionalism, yet enforcement within Vietnam remains a legal and procedural hurdle.

Parties should weigh the benefits of an independent tribunal against the practicality of domestic execution, particularly when the respondent’s assets are located in Vietnam.

M&A Is More Than a Deal — It’s a Legal Commitment

The VMG–UTC dispute stands as a sobering reminder that M&A is not merely a financial transaction, but a long-term legal relationship governed by trust, accuracy, and professional diligence.

As Vietnam deepens its integration into global capital and investment markets, the institutional discipline of M&A practice — from due diligence to post-closing governance — will determine whether local enterprises can truly thrive on the international stage.

Vietnamese version HERE

La Défense Vietnam Law Firm

November, 2025