Anti – Dumping issue, A Practical Survival Guide for International Businesses

As Vietnam strengthens its position in global trade, its enforcement of anti-dumping rules has grown more assertive and sophisticated. For many years, exporters viewed Vietnam as a “soft jurisdiction” compared to the US or EU. That era is over.

Recent anti-dumping cases in steel, plastics, fertilizers, chemicals, and consumer goods show a clear message:

Exporting to Vietnam without a trade-compliance strategy is no longer safe.

For foreign companies suddenly facing an anti-dumping investigation in Vietnam, swift and strategic action is crucial. This article breaks down what exporters must do immediately, how to respond professionally, and how local legal guidance can protect your position.

✅ What Triggers Vietnam to Investigate?

Vietnam’s Ministry of Industry & Trade (MOIT), through the Trade Remedies Authority (TRAV), may initiate an investigation when:

- Domestic manufacturers file a valid petition

- There is strong evidence of price dumping

- Imports surge rapidly and harm local producers

- There are signals of origin shifting or trans-shipment

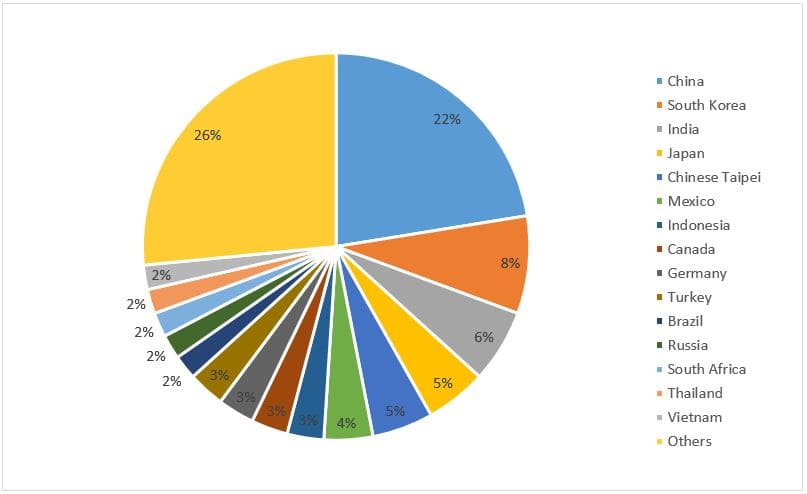

Exporters from China, South Korea, Thailand, Malaysia, Taiwan, the EU and India have been subject to recent investigations — reflecting Vietnam’s key trading partners.

✅ Key Risks for Foreign Exporters

Facing an anti-dumping case in Vietnam is not simply a paperwork task. The consequences can be severe:

| Risk | Consequence |

| Provisional & final anti-dumping duties | Loss of profitability / market exit |

| Adverse Facts Available (AFA) | Highest punitive tariff if you fail to cooperate |

| Supply chain delays | Customs holds & shipment uncertainty |

| Reputational impact | Signals risk to other markets & regulators |

| Litigation & compliance burden | Significant time and resource allocation |

Failure to respond properly can permanently damage access to Vietnam, one of Asia’s fastest-growing consumption markets.

✅ Step-by-Step: How Companies Should Respond

1) Act Immediately — Time Is Critical

Vietnam’s deadlines are strict. Missing a submission deadline can instantly place exporters in the non-cooperating group, subject to the highest duty rate.

✔️ Appoint a response team

✔️ Engage Vietnamese trade counsel

✔️ Coordinate internally across HQ, finance, and legal departments

2) Understand the Scope and Products

Authorities will examine:

- Product classification

- Manufacturing origin

- Cost structure & normal value

- Export price to Vietnam

- Sales volumes & market share

If your group includes multiple subsidiaries, all relevant entities must coordinate responses.

3) Prepare to Respond to Questionnaires

TRAV issues detailed questionnaires similar to WTO and US/EU systems.

They require:

- Cost structure

- Production costs & overhead

- Sales price data

- Accounting records

- Export-specific documentation

Accuracy, consistency, and traceability are critical.

Even minor inconsistencies may lead authorities to doubt credibility.

4) Maintain Transparent Financial Records

Exporters must provide:

- Cost accounting tables

- Sales ledgers and invoices

- Transfer-pricing documents if applicable

- Audit records

Poor documentation = vulnerability

Opaque records = high duty risk

5) Prepare for On-Site Verification

Vietnam authorities typically verify data through:

- Factory visits

- Document audits

- Interviews with finance and management

Your team must be ready.

A well-handled verification builds credibility.

Mistakes can be costly.

6) Avoid the “Non-Cooperation Trap”

Many exporters panic and remain silent to “avoid trouble.”

But not responding guarantees trouble.

Non-cooperation =

❌ No defense rights

❌ Highest default duty

❌ Long-term regulatory attention

Responding professionally often leads to:

✅ Lower duty margins

✅ Better dialogue with regulators

✅ Possibility to secure “zero-duty” status

✅ Strategic Defense Tips

|

Strategy |

Why It Matters |

| Start compliance preparation early | Avoid panic and rushed responses |

| Engage Vietnamese counsel & international advisors | Local insight + international expertise |

| Segment product data | Prevent blanket duties |

| Explain pricing logic clearly | Prevent “assumed dumping” |

| Ensure internal alignment | No mixed messages to authorities |

| Monitor communication tone | Professionalism matters |

Vietnam’s regulators expect transparency, cooperation, and timely responses — and they appreciate companies that respect the process.

✅ Common Mistakes Exporters Make

| Mistake | Result |

| Ignoring notices or responding late | Automatic highest tariff |

| Assuming Vietnam’s process is “lenient” | Damaging misconception |

| Relying solely on in-house teams | Local legal context often missed |

| Providing incomplete documentation | Loss of credibility |

| Poor communication with authorities | Adverse rulings more likely |

Preventable mistakes often cost more than professional support.

✅ Role of Local Legal Counsel in Vietnam

A Vietnam-based trade law team provides critical value:

- Guide questionnaire preparation

- Coordinate filings and extensions

- Support onsite inspections

- Engage with TRAV professionally

- Ensure compliance with Vietnamese law & WTO norms

- Work with your international counsel and accountants

The right advisors protect your business, market, and long-term compliance posture.

🇻🇳 Why International Companies Choose La Défense

La Défense is one of Vietnam’s leading legal practices for:

- International trade & WTO law

- Anti-dumping and trade remedy defense

- Supply-chain structuring & customs advisory

- Cross-border dispute resolution and litigation

- FDI regulatory compliance & import-export law

We provide:

✅ Deep knowledge of Vietnam’s trade laws and TRAV practice

✅ Experience supporting foreign manufacturers & global counsel

✅ English-ready communication and business-minded advice

✅ Practical defense strategies tailored to international operations

✅ Integrity, confidentiality, and client-focused execution

We defend your right to access the Vietnamese market — and help you operate with confidence and compliance.

Preparation = Protection

Vietnam welcomes foreign businesses — but expects fair pricing and transparent practices.

To successfully navigate anti-dumping investigations:

- React fast

- Cooperate professionally

- Maintain clear documentation

- Use experienced local legal counsel

Companies that prepare early and respond strategically preserve market share and credibility. Those that delay or underestimate the process risk losing access to a dynamic and expanding market.

Need Assistance on Anti – Dumping?

If your company is under investigation or wants proactive trade-compliance support in Vietnam, our team is ready to assist.