Global Wealth Relocation: The Shifting Landscape

In the face of rapidly evolving geopolitical and economic dynamics, global wealth flows are undergoing a transformation. High-net-worth individuals (HNWIs) and multinational businesses are now adopting a more holistic approach to choosing their locations, prioritising not only investment opportunities but also quality of life. As this shift accelerates, Vietnam is emerging as a compelling destination—but the country must act quickly by enhancing its policy frameworks, infrastructure, and living standards.

Traditional HNWI Hubs Losing Ground

Historically, global cities such as New York, London, Paris, Monaco, and Tokyo have attracted HNWIs—individuals with over $1 million in liquid financial assets, excluding primary residences. However, these traditional hubs are gradually losing appeal to rising competitors like Dubai, Abu Dhabi, Singapore, Milan, and Sardinia. These newer destinations are offering enticing golden visa programs, tax incentives, and high-quality lifestyles, making them more attractive to globally mobile elites.

Corporate Relocation Driving HNWI Movements

The current wave of wealth relocation is being driven significantly by multinational corporations. According to Savills Impacts, trends like nearshoring and onshoring are gaining traction, especially in high-tech industries such as AI, semiconductor manufacturing, and data centres. These sectors demand a skilled workforce and reliable energy sources—factors closely tied to geographic and infrastructure considerations.

Successful business location decisions revolve around three core elements: people, power, and proximity. Companies seek access to skilled labor, dependable energy supply, and a strategic ecosystem that includes suppliers, partners, and a resilient supply chain.

The ‘Triple Helix’ and Global Investment Hubs

Savills further highlights the importance of the ‘triple helix’ model—the collaboration between universities, the private sector, and government. This synergy is a key driver behind future capital flows. Global hubs like Silicon Valley (USA), the Golden Triangle (UK), and the Greater Bay Area (China) are not only innovation and business centers but also premium living environments for global elites. These regions combine quality of life with favorable investment conditions, creating lasting global appeal.

Lifestyle and Community: New Drivers for HNWIs

Today’s HNWIs look beyond just tax and financial benefits. They increasingly value culture, healthcare, education, and overall quality of life. According to Victoria Garrett, Head of Global Residential at Savills (excluding the UK), while tax incentives remain crucial, HNWIs also seek beachside living, access to international schools, golf courses, and a like-minded community.

Top Cities Attracting Wealth: Insights from the Savills Dynamic Wealth Index

The Savills Dynamic Wealth Index evaluates cities excelling at attracting and developing wealth from both individuals and businesses. Cities such as Dubai, Abu Dhabi, Singapore, Zurich, and Auckland rank among the top five for HNWI relocation, thanks to favorable personal tax regimes, an established HNWI community, and a high standard of living.

For businesses, top destinations include Singapore, Seoul, New York, London, and Abu Dhabi—cities that offer competitive corporate tax structures, strong FDI inflows, ease of doing business, and a rich knowledge base.

Interestingly, six of the top 12 cities appear in both individual and business categories, highlighting how personal and corporate priorities are increasingly aligned. Businesses gravitate toward places that attract talented workers—and talented workers seek locations with a better quality of life.

Expert Insight: Why Vietnam Needs to Act Now

Paul Tostevin, Director of World Research at Savills, notes that in this evolving landscape, governments that provide tax incentives, skilled labor, and a sense of community are best positioned to capture global wealth. The standard of living is becoming a defining factor for where the elite choose to settle.

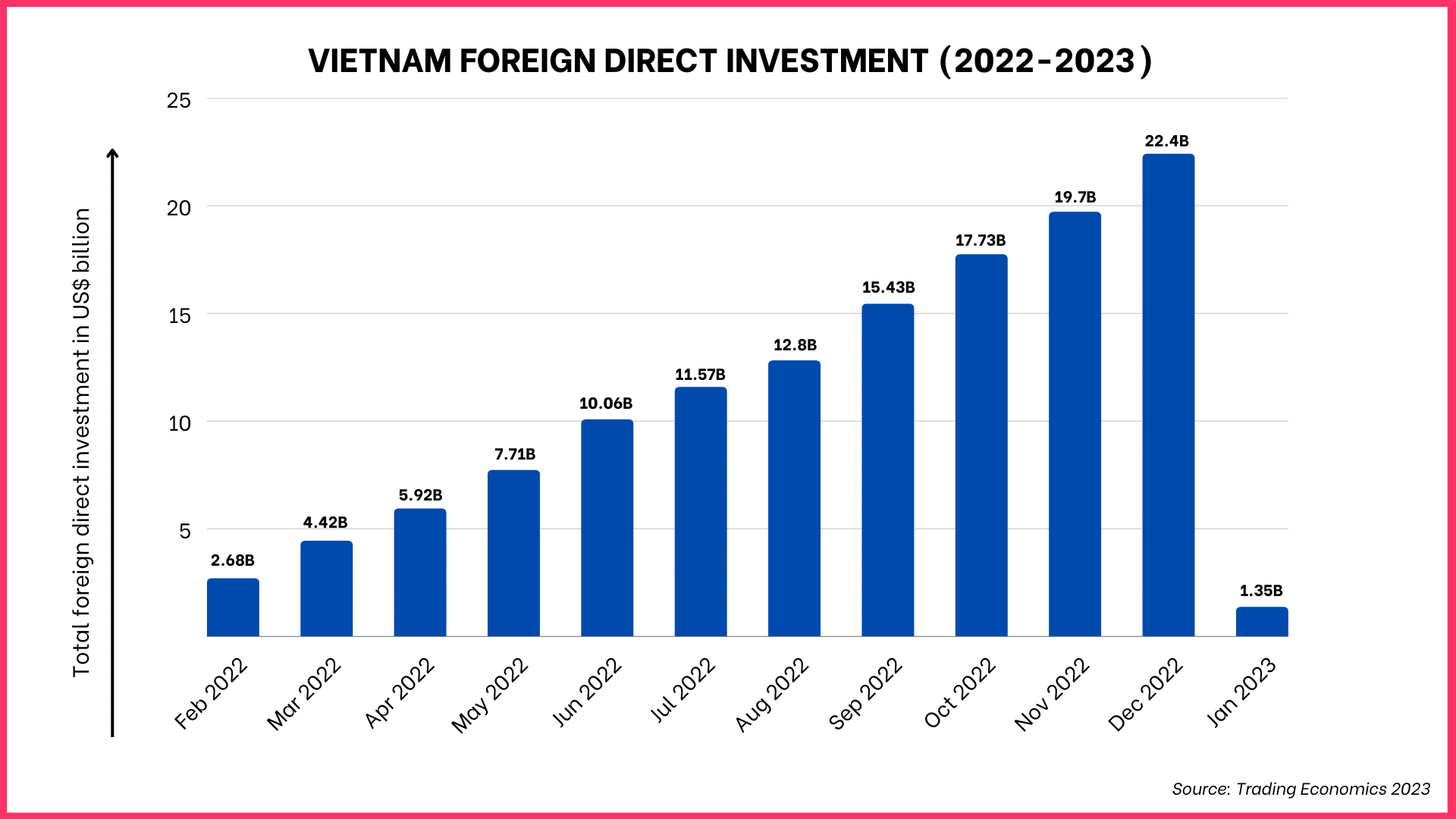

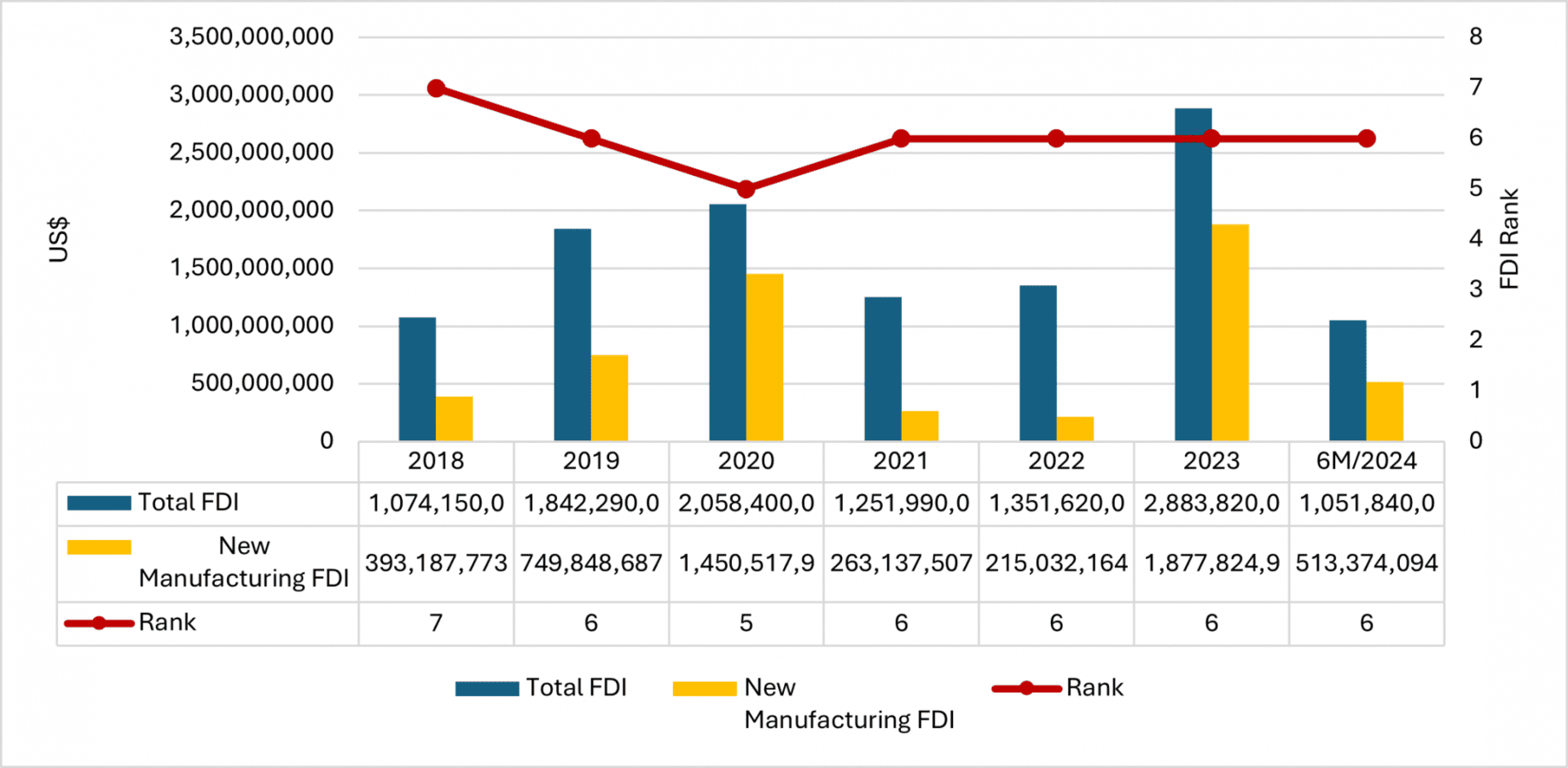

Vietnam’s Competitive Edge in the Global Investment Race

According to the Ministry of Finance’s Foreign Investment Agency, Vietnam continues to attract strong FDI despite global uncertainties. In the first five months of 2025, foreign investment reached $18.4 billion, marking a 51.2% increase year-on-year.

– Manufacturing and processing led the charge with $10.4 billion, accounting for 56.6% of total registered capital.

– Real estate followed with $4.99 billion, or 27.1%, more than doubling from the previous year.

– Science and technology attracted $1.02 billion, while the wholesale and retail sector brought in $596.8 million.

Real Estate Hotspots for HNWIs in Vietnam

Matthew Powell, Director of Savills Hanoi, highlights Vietnam’s appeal to HNWIs, citing its strategic Southeast Asian location, rapidly growing economy, and rich cultural landscape. Destinations like Danang and Hoian are rising as luxury resort hotspots, featuring international-standard golf courses, mild climates, and high-end branded residences like Nobu Residences and Hoiana.

Meanwhile, Hanoi and Ho Chi Minh City—Vietnam’s key economic hubs—are seeing robust growth in branded apartments and villas, infrastructure upgrades, and better connectivity to global financial centers.

Reforms Needed for Sustainable Growth

Despite its strengths, Vietnam must implement decisive reforms to remain competitive. Powell emphasizes the need for flexible visa policies and residency programmes tailored to HNWIs. Regional competitors like Thailand and Malaysia have already adopted long-term residence visas with tax incentives, property rights, and favorable employment conditions.

To truly become a global HNWI destination, Vietnam must develop a high-quality living ecosystem—including world-class healthcare and education. As Powell notes, when wealthy individuals experience consistent comfort and professionalism, they are likely to return and even promote the country internationally.

A Strategic Moment for Vietnam

Investor-friendly visa policies should not be seen merely as entry tools but as a core element of Vietnam’s long-term development strategy. As the global relocation of wealth continues, Vietnam is well-positioned to become a top-tier destination for HNWIs. With its natural diversity, strategic geographic location, and growing economic appeal, Vietnam has the potential to lead in investment, high-end living, and sustainable development.

Orther related legal articles:

- Business Formation in Vietnam: A Legal Checklist for Expats

- Setting Up a Logistics Hub in Vietnam for Taiwanese Businesses

- Legal Services Every Expat Business Owner in Vietnam Needs

- How Do I Register Business Name in Vietnam?